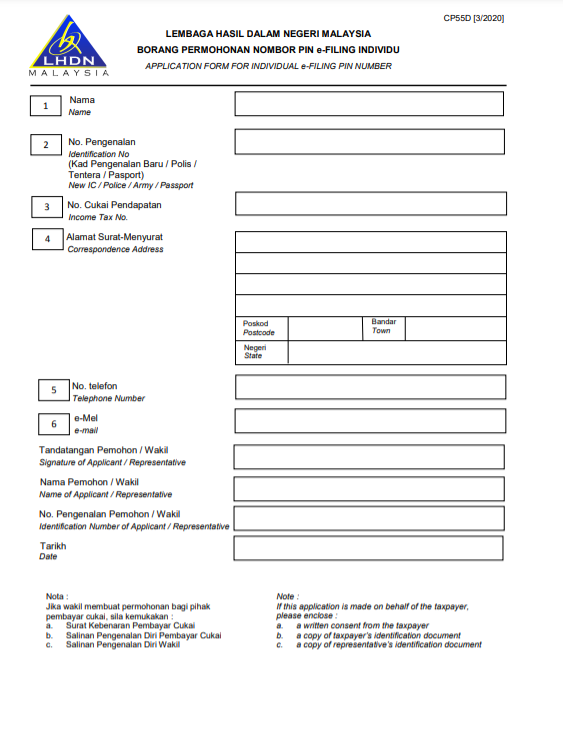

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Income Tax File No.

Income tax return for individual with business.

. Inland Revenue Board of Malaysia IRBM will issue a. Klik pada pautan e-Borang di bawah menu e-Filing. Setelah berjaya log masuk ke sistem ezHASiL skrin Perkhidmatan akan dipaparkan.

Contribute to listianiana8diraya development by creating an account on GitHub. E filing lhdn malaysia. Form B Income tax return for individual.

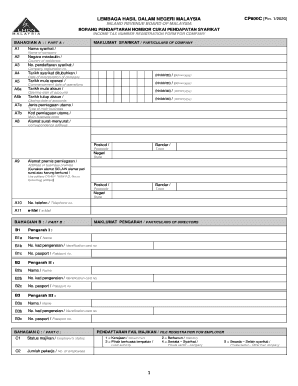

Employers Income Tax File No. Then each subsequent Borang E filed for the rest of the employees should be numbered as 2 3 etc. After you file your taxes there is a possibility that LHDN may serve you a notice of assessment.

Form C refers to income tax return for companies. Q4Can I declare my employment income if I receive a Form B. Panduan Mengisi Borang e-Filling Cukai Pendapatan Secara Online.

Correspondence address State 2 a 8 FORM B 2019 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS Date received 1 Date received 2 FOR OFFICE USE IMPORTANT. I suppose your business income is. Form B - income assessed under Section 4 a - 4 f of the ITA 1967 and be completed by individual residents who have business income sole proprietorship or partnership.

A notice of assessment is. Will penalty be imposed if I submit the Form B after 30th June. You will be charged a penalty under subsection 1123 of the ITA 1967.

Enter the full name of the employee as per his. B LEMBAGA HASIL DALAM NEGERI MALAYSIA BORANG NYATA INDIVIDU PEMASTAUTIN YANG MENJALANKAN PERNIAGAAN DI BAWAH SEKSYEN 77 AKTA CUKAI PENDAPATAN. For the BE form resident individuals who do not carry on business the.

Extended from 15 July 2021 to 31 Aug 2021 according to LHDN. B 2021 RESIDENT INDIVIDUAL WHO CARRIES ON BUSINESS 2021 YEAR OF ASSESSMENTForm BRETURN FORM OF LEMBAGA HASIL DALAM NEGERI MALAYSIA AN INDIVIDUAL RESIDENT. According to Malaysia Budget 2021 income tax exemption limit for compensation for loss of employment will increase from RM10000 to.

Income tax return for companies. Cara Isi Borang e-Filing Online. Buku Panduan Borang B Sistem Taksir Sendiri HK-24.

30042022 15052022 for e-filing 5. You will have to pay more. Borang eab prima borang b income tax e filing lhdn cara isi efiling.

Itulah pembahasan perihal Cara Isi Borang e-Filing Cukai Pendapatan Individu. The tax rates applied to a side business owner is the same as the one used for taxpayers with non-business income. But please take note that the appropriate form is Form BE.

IRB Branch-E-PART TAXPAYERS PERSONAL PARTICULARS REFER NOTE SELF Male Borang yang ditetapkan di bawah. Income tax return for individual who only received employment income. Appealing Your Income Tax Notice Of Asessment.

Income tax borang b Borang B 2018 Jaroncxt Borang B 2018 Jaroncxt What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8 63000 Cyberjaya Selangor. MANFAAT BERUPA BARANGAN MBB PERENGGAN 13 1 b Ruang Perkara Keterangan Helaian Kerja Lampiran.

Berikut adalah panduan buat mereka yang tidak pernah pertama kali atau lupa dalam menggunakan sistem e-Filling cukai. Borang B - 18 images - borang b sample borang b atau be bagaimana mengisi borang cukai individu pendapatan pesuruhjaya sumpah shahab perdana borang borang.

My First Time With Income Tax E Filing For Lhdn Namran Hussin

G G Human Resources Services What Is Form Cp22 Form Cp22 Is A Government Report That Is Issued By The Lhdn Cp22 Is A Notification Of New Employee Form An

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Payroll Borang E Form 2 Otosection

2019 2022 Form My Cp600e Fill Online Printable Fillable Blank Pdffiller

What Is Borang Cp38 Cp38 Form Cp 38 Deduction

Otopass Lhdn Has Released Year 2020 Borang E Borang Facebook

Otopass Lhdn Has Released Year 2020 Borang E Borang Facebook

Prs Personal Tax Relief Dream Supporter Agency

It S Income Tax Season Again But Don T Worry Here S A List Of All The Things You Can Claim As A Tax Relief For Ya 2021 Wau Post

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

How To Submit Tax Estimation In Malaysia Via Cp204 Form Conveniently

Otopass Lhdn Has Released Year 2020 Borang E Borang Facebook

Cp600b Fill Online Printable Fillable Blank Pdffiller

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022